by Hilarie M. Sheets

https://www.youtube.com/watch?v=kmVcxfIdrMk&feature=youtu.beThe former Johnson Publishing Company was a poerful force of creaotivity, culture adn commerce. It financed the design and manufacture of its downtown CHicago office building.

Now forever lost due to its heris selling the building and giving away too many of its assets. It unique art collection went up adn sold well at the Swann Galleries Auction in NY this year..generating more spending change for its heir. But what of us...the people? Or the wellness of Black Culture? What of it? Non-Blacks would never sell its assets to Blacks....never!

-----------------------------------------------------------------------------------------------------------------------------

As a full-time small business owner since 1981, I've long been a proponent of supporting artisans and shopping locally whenever possible. But when I began researching to prepare for a blog post about why shopping small is so important, I was incredibly encouraged to unearth this data.

- Seventy-seven million Americans are employed by small business. That’s 2 out of every 3 private sector jobs in the United States. According to the SBA, small businesses have created 66% of all new jobs since 1995.

- Every $10million of spending at a local company creates 57 jobs while that same spending at Amazon creates just 14 jobs.

- According to the SBA, big businesses have eliminated 4 million jobs since 1990, while small businesses added 8 million jobs within that same time period.

- A series of studies by the research firm Civic Economics found that 48 percent of purchases at local independent businesses go right back into the community, compared to less than 14 percent of sales made at chain stores.

Three cheers for small businesses! Want to dig deeper? I published a blog post late last year which makes a strong case for the power and importance of small businesses. I'm putting it back on your radar because it's highly share-able and makes a compelling case for shopping small this season.

READ MORE ABOUT WHY SMALL BUSINESSES MATTER >>

https://www.citylab.com/equity/2019/09/racial-wealth-gap-history-slavery-black-white-family-income/597100/?utm_source=pocket-newtab

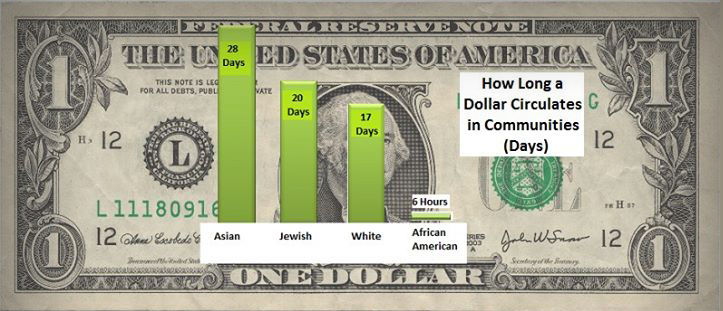

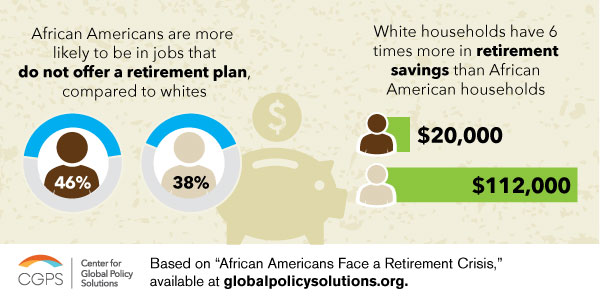

The above is a link covering research on the mass cross generational theft of Black wealth. Now I pose, add this to how Blacks avoid doing business too many times with Blacks and have little to no patience, love or insights about what is at stake when buying Manga, Made in Japan, Made In China or Made In Korea. At least Made in the USA includes Blacks earning and saving. How many Blacks do we ever see working in a business owned by Chinese.......

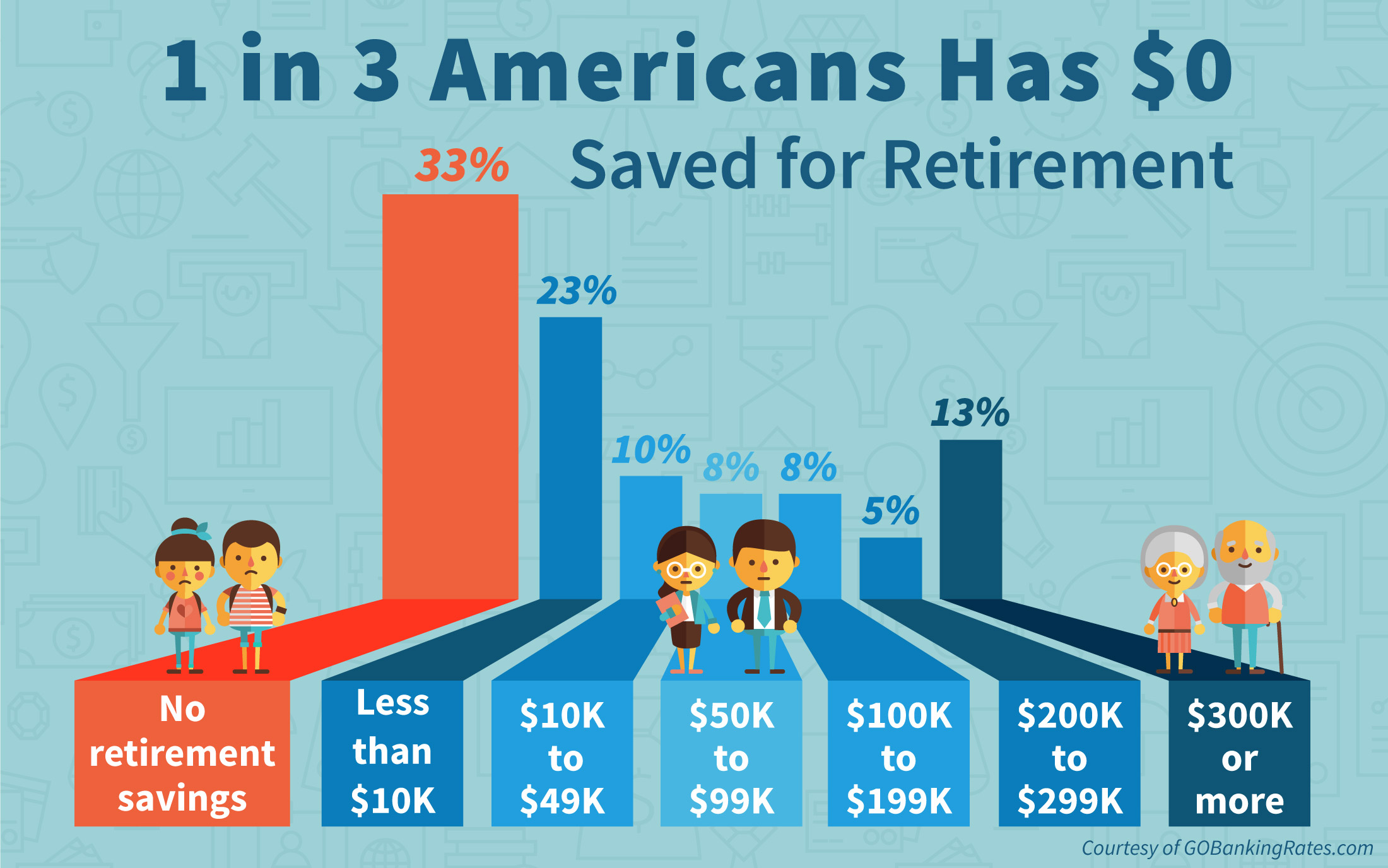

Remove our insistance on thug-life, crime and violence as cultural and social expressions, Blacks would then create a setting to grow wealth. If not, once given, reparations will simply end up in CHina, Japan and Korea....and back to the hiers of slavers. Plan to succeed or plan to fail....again.

Dealing in Black Money means to support and brag about a legal honest well run Black owned business. Not only talking about the poorly run ones.

Black buying power in the USA is now over 1.5 trillion dollars:

The goal of this group is to manifest the Principles of Kwanzaa into an every day practice with Blacks buying products and services from other Blacks as a casual act instead of a forced, rare or awkward practice. This will grow power, prestige and more money!

Being Black should not be a reason to not buy from another Black!.

Black profits matter! End the Balck On Black Boycott of legal honest businesses & professionals and prosper!

Negative folks are invited to not be a part of this group. Spend your money and time in your beloved "mainstream!". This is about our DREAM!

Comments